Client Alert: It’s About (Over)time – The Sequel

Washington State implements new “overtime rules” that may effect the exempt status of thousands of Washington State employees

As avid subscribers to CH& employment updates, you recently received our Client Alert about recent changes to the federal “overtime rules,” which increased the salary threshold necessary for a worker to be considered exempt from overtime and other protections of the Fair Labor Standards Act.

Not to be outdone, on December 11, 2019, the Washington State Department of Labor & Industries (“L&I”) announced similar changes to the overtime exemptions applicable to Washington’s Minimum Wage Act (the “WMWA”).

Increased “Salary Test” Threshold

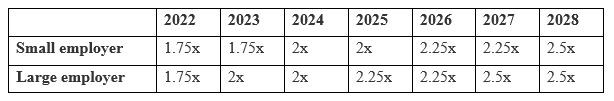

Whether under federal or state law, in order to be properly classified as “exempt,” a worker must be paid on a salary basis, and the salary must meet the minimum threshold set by law. Under the new L&I rules, the minimum salary threshold applicable to Washington workers will increase incrementally to 2.5 times the state minimum wage by 2028. Companies with 50 or fewer employees (“small employers”) will have a more gradual phase-in schedule than large employers (51 or more employees). The first threshold increase will go into effect on July 1, 2020.

That first salary increase will be 1.25 times the state’s hourly minimum wage of $13.50 ($540/week assuming a 40-hour work week). Accordingly, the minimum salary under Washington law in order for an exemption to apply would be $675 per week in 2020, or $35,100 per year. In 2021, the multiplier will increase to 1.5 for small employers and 1.75 for large employers. Subsequent increases will be implemented as follows:

At least as currently written, the multiplier will remain 2.5x minimum wage from 2028 on. Of course, the threshold salary itself cannot be calculated after 2020 because the state minimum wage is unknown after next year. L&I estimates the threshold will exceed $83,000 by 2028.

Changes to the “Duties Test”

In addition to meeting the salary requirements, employees must also perform certain duties in order to be considered exempt. The new L&I rules also update this “duties test” to bring it more in alignment with federal law. The changes are too extensive to go into here, and require a case-by-case analysis to ensure compliance. Be sure to talk with your employment counsel if you have any concerns about whether your employees are properly classified as exempt.

Overlap with Federal Law

By now you’re probably thinking, “But wait! You just told me there are change to the federal requirements as well. What gives?!” Good catch. Keep in mind that you have to follow the law that provides the most protection to employees. With regard to the minimum salary threshold, the federal minimum salary threshold of $35,568 will apply in 2020 because it is higher than Washington State’s minimum. To the extent the Washington salary threshold exceeds $35,568 in future years, then the state minimum will apply.

Because the duties test under federal and state law are now substantially similar, compliance with one will generally mean compliance with the other.

Next Steps

If you have employees classified as exempt who do not receive a salary of at least $35,568 as of January 1, you will either need to increase their salary or change their status to non-exempt and start paying overtime for hours worked in excess of 40 per week.

If the salary of your exempt employees meets or exceeds the minimum, it may still make sense to make sure their duties align with the requirements of the “duties test,” particularly if you haven’t audited this in a while. As always, confer with your employment counsel to ensure you are in compliance.